The Spanish Agency for International Development Cooperation (AECID) has greenlit a commitment of up to $10 million to Novastar Ventures’ Africa People + Planet Fund III (NVIII).

This investment stands as Spain’s largest-ever pledge to a pan-African impact venture fund, underscoring Madrid’s deepening role in channelling climate-aligned finance to the continent.

As Africa’s economies grapple with rapid urbanisation, resource strains, and the urgent imperative of net-zero transitions, NVIII emerges as a catalyst for scalable, green innovation.

The Fund Quick Overview

Managed by Nairobi-headquartered Novastar Ventures, NVIII is a $200 million+ vehicle launched in 2025, laser-focused on early- and growth-stage companies driving “people + planet” outcomes.

The fund targets transformative businesses in four high-impact sectors:

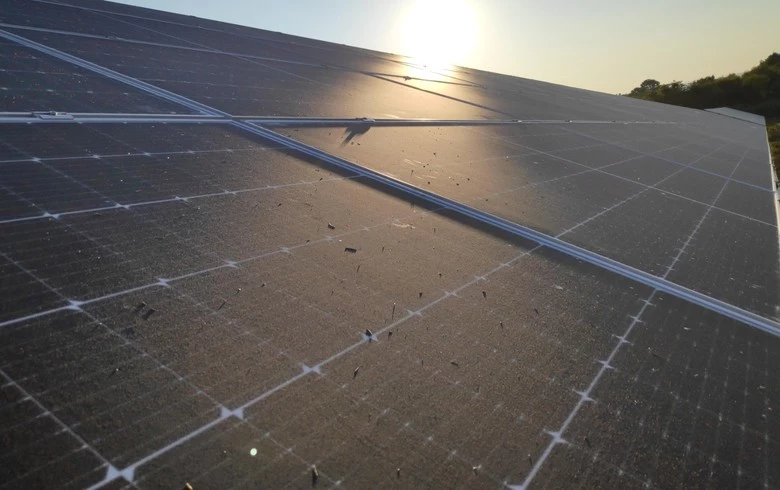

- Renewable energy & off-grid solutions: Powering remote communities with solar, mini-grids, and biogas tech to slash reliance on fossil fuels.

- Electric mobility & smart logistics: electrifying transport fleets and optimising supply chains to cut urban emissions and boost efficiency.

- Circular economy & waste-to-value: Turning trash into treasure through recycling, upcycling, and zero-waste models.

- Regenerative agriculture & food systems: revitalising soils, enhancing yields, and building climate-resilient farming for smallholders.

NVIII’s portfolio already includes early bets like a $3 million+ investment in Sistema.bio, a Mexican-origin biogas innovator expanding across sub-Saharan Africa to convert farm waste into renewable energy and fertiliser, potentially uplifting over 100,000 smallholder farmers.

Projections suggest the fund could mobilise private capital, create millions of green jobs, and curb emissions in Africa’s burgeoning markets, where climate vulnerabilities affect hundreds of millions.

AECID’s anchor investment not only propels NVIII toward its final close but also amplifies a group of global backers.

The Green Climate Fund (GCF) committed up to $40 million in October 2025 to turbocharge climate-tech ecosystems in nations like Kenya, Nigeria, Ethiopia, and Ghana, comprising countries home to vast climate-vulnerable populations.

Other heavyweights include Swedfund ($10 million, September 2024), British International Investment (BII) ($10 million), Norfund, Sumitomo Mitsui Banking Corporation (SMBC), and the Japan International Cooperation Agency (JICA).

This coalition reflects surging institutional confidence in Africa’s impact on the VC space, especially as the continent eyes $2.8 trillion in climate and Sustainable Development Goal (SDG) financing by 2030 yet receives just 12-15% of global climate funds today.

As Novastar Ventures stated in response to the AECID news: “AECID joins a powerful coalition of global investors in NVIII who share one conviction: Africa’s entrepreneurs are building the clean, inclusive future the world needs. This commitment from Spain accelerates that vision.”

The Beneficiaries

Here’s who stands to gain, backed by the fund’s structure and early traction:

1. African Entrepreneurs and Climate-Tech Startups

At the epicentre are the innovators: bold founders scaling solutions for Africa’s unique challenges. NVIII provides not just equity but hands-on support, including mentorship, market access, and networks to help these ventures leap from pilot to pan-continental impact.

Take GreenWheels, an NVIII portfolio darling redefining electric logistics in Kenya, or emerging plays in regenerative ag that could double smallholder incomes while sequestering carbon.

By 2030, such investments could create thousands of startups, creating a self-sustaining climate-tech hub where private returns lure even more capital.

For entrepreneurs long starved of patient, risk-tolerant funding, AECID’s bet means faster paths to viability and a shot at unicorn status in green tech.

2. Low-Income Communities and Marginalised Populations

NVIII’s “for the many, not the few” ethos targets the base of the pyramid: the 600 million+ Africans in low-income households.

Off-grid solar could electrify rural schools and clinics, electric mobility might slash transport costs for urban gig workers, and waste-to-value initiatives could create local jobs in recycling hubs.

In climate hotspots like Ethiopia’s drought-prone highlands or Nigeria’s flood-ravaged deltas, regenerative farming promises resilient food security for millions.

Early metrics from Novastar’s prior funds show over 2 million direct beneficiaries; NVIII aims to exceed that, prioritising women-led enterprises and underserved regions to drive inclusive growth.

3. The Planet: Emissions Cuts and Resilience Builders

Africa’s growth story is a double-edged sword—projected to house 25% of the world’s population by 2050, yet emitting just 4% of global GHGs today. NVIII counters this by backing ventures that align economic expansion with planetary health.

Expect gigatons of avoided CO2 from renewable deployments, circular models that divert billions of tons of waste from landfills, and ag practices that restore degraded lands.

GCF’s involvement underscores the fund’s role in Nationally Determined Contributions (NDCs), bridging the adaptation finance gap and fortifying ecosystems against shocks like erratic monsoons or heatwaves.

4. Investors and Development Institutions Like AECID

For AECID, this is strategic diplomacy: amplifying Spain’s soft power in Africa while delivering measurable SDG returns. As an anchor, it de-risks the fund, attracting peers and yielding blended returns (financial + impact).

Broader DFIs benefit from pooled resources. Swedfund’s Sofia Gedeon noted how NVIII’s East-West Africa footprint unlocks “high-impact companies” continent-wide.

Over time, successful exits could recycle capital into future funds, proving impact investing’s viability and drawing in commercial LPs like pension funds wary of frontier risks.

5. Africa’s Broader Economy and Job Market

NVIII’s sectors could generate millions of roles in manufacturing, installation, and services, from solar technicians in rural Kenya to logistics coders in Lagos.

This fuels GDP uplift, reduces import dependence on dirty energy, and stimulates supply chains. By building local innovation ecosystems, the fund counters brain drain, empowering youth (Africa’s median age: 19) with skills for a low-carbon future.

A Green Signal for Global Capital

As Europe shifts from aid to investment, Spain’s move reinforces a multilateral push: from GCF’s $40 million anchor to Japan’s $200 million exploration via SMBC.

Together, they’re not just funding deals; they’re architecting a resilient, equitable Africa that leads the global clean transition.

Novastar Ventures: Key Details and Search Guide

Novastar Ventures Africa Fund II is one of the firm’s flagship impact investment vehicles focused on high-growth businesses across East and West Africa.

In East Africa, Novastar Ventures Kenya plays a central role in sourcing and scaling ventures that address market gaps in essential services.

The firm operates from its regional hub in Novastar Ventures Nairobi, where most portfolio support, founder engagement, and investment operations are coordinated.

Those seeking opportunities within the firm can explore openings under Novastar Ventures Kenya careers, which typically cover investment, portfolio support, and impact roles.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.