What if Kenya’s sunshine could power every home and business? With the right investment in solar energy, this vision is closer than ever, despite the challenge of upfront costs.

That’s where financing comes in. This guide explores the latest solar financing options in Kenya as of 2025, from government-backed incentives to innovative pay-as-you-go models, helping homeowners, businesses, and farmers make the switch affordably.

Whether you’re searching for solar loans in Kenya or affordable solar financing options, we’ll break down the pros, cons, and steps to get started, all backed by up-to-date facts.

Why Invest in Solar Energy in Kenya Now?

Kenya’s solar market is booming, projected to grow by over 40% in 2025, fuelled by falling equipment costs and supportive policies.

Solar power not only cuts electricity bills by up to 50% but also combats climate change, with the sector already reducing carbon emissions significantly in projects like large-scale solar farms.

For businesses, it means stable energy costs amid rising grid tariffs, while rural households gain access to off-grid solutions.

The government’s National Energy Policy 2025–2034 emphasises harnessing renewables like solar to achieve universal electricity access by 2030.

With incentives like VAT exemptions on solar products, now is an ideal time to explore financing.

Government Incentives and Policies Supporting Solar Financing

The Kenyan government plays a crucial role in making solar accessible through tax breaks, subsidies, and programmes. Key highlights include:

- Tax Exemptions and Deductions: Solar equipment like panels, inverters, and batteries enjoys VAT and import duty exemptions, saving buyers up to 16% on costs.

However, the Finance Bill 2025 proposed reclassifying solar goods from zero-rated to VAT-exempt, potentially limiting input tax recovery and increasing effective costs for businesses.

Additionally, the Income Tax Act offers a 100-150% investment deduction for qualifying renewable projects outside major cities.

- Net-Metering Regulations: Introduced in 2024, this allows households and businesses to sell excess solar power back to the grid at 50% credit per kWh, with caps at 10 kW for homes and 1 MW for commercial users.

- Kenya Off-Grid Solar Access Project (KOSAP): A World Bank–funded initiative that has electrified over 1.5 million people via mini-grids, with 62 operational as of 2025.

- Draft National Green Fiscal Incentives Policy: Proposes further tax breaks for solar structures and waste reuse in renewable projects.

These policies reduce barriers, but applicants should confirm details with the Energy and Petroleum Regulatory Authority (EPRA).

Traditional Bank Loans and Green Financing Options

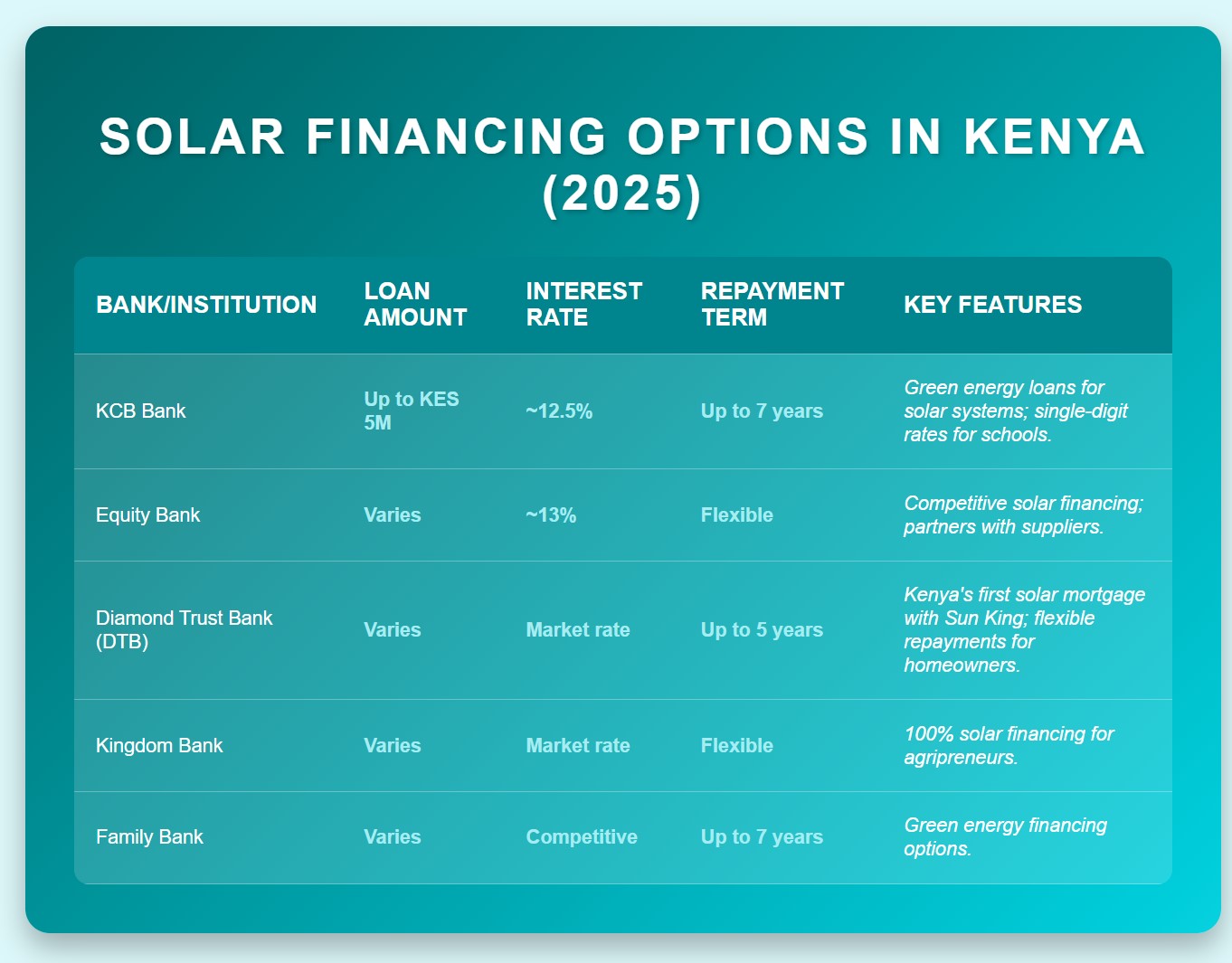

Local banks have ramped up green lending, offering tailored solar loans with competitive rates.

Pros: Lower interest than standard loans (8.5–13% vs. 18%+ for commercial).

Cons: Requires credit checks and collateral.

Standard Chartered doubled its green financing revenue to $23M in 2024, signalling growing bank support.

READ ALSO:

Choosing the Right Solar Partner: A Guide to Kenya’s Top Solar Service Providers

Pay-As-You-Go (PAYG) Models: Affordable Entry for Off-Grid Users

PAYG has transformed solar access in rural Kenya, allowing users to pay in small instalments via mobile money. Leading providers include:

- Sun King: Secured $156M in 2025 funding from banks like Absa, Citi, and DFIs like Norfund. Offers solar home systems with flexible payments; over 2 million units sold in Kenya.

- M-KOPA and d.light: Popular for small systems; users pay daily/weekly until ownership.

Pros: No upfront costs, credit scoring via usage data.

Cons: Higher long-term costs due to interest.

By 2025, these schemes are expected to reach more underserved regions through government incentives.

Lease-to-Own and Power Purchase Agreements (PPAs)

For larger installations, these models shift costs to providers:

- Lease-to-Own: NCBA Leasing and PowerPoint Systems offer zero upfront payments, fixed monthly instalments, and ownership at term’s end (5–7 years).

- SolarAfrica: Provides pay-for-use contracts, covering installation for businesses like malls and camps. Example: An 858 kWp system at Garden City Mall saves 745 tonnes of CO₂ annually.

Pros: No capex; predictable costs.

Cons: Long-term commitments.

International and Blended Financing for Scale

Blended finance combines public and private funds to de-risk projects:

- Climate Investment Funds (CIF): Endorsed a $70M plan in 2025 to boost variable renewables like solar from 19% to 30% by 2030.

- DFIs and Facilities: Norfund, FMO, and others back concessional loans (1–2% rates) and risk mitigation like RLSF for up to 100 MW projects.

Pros: Low rates, large-scale support.

Cons: Complex applications, often for commercial projects.

Challenges in Solar Financing in Kenya

High capital costs (3–7x higher than in developed markets) and currency risks persist. Awareness gaps in rural areas and policy shifts like the Finance Bill could raise costs. Mitigation includes hedging tools and community engagement.

How to Get Started with Solar Financing

- Assess your needs:Use online calculators from providers like SolarAfrica.

- Check eligibility:For loans, prepare financial docs; for PAYG, a mobile money account suffices.

- Apply: Visit bank branches, company websites, or EPRA for incentives.

- Consult experts: Firms like Plexus Energy offer smart financing advice.

Powering Kenya’s Future with Solar

From bank loans to innovative PPAs, Kenya’s solar financing ecosystem in 2025 makes clean energy more accessible than ever.

By leveraging government incentives and private options, you can reduce costs and contribute to a sustainable future. Start exploring today; contact a provider or visit the Ministry of Energy site for personalised guidance.

FAQs on Solar Financing in Kenya

What is the cheapest solar financing option? PAYG for small systems; bank loans for larger ones.

Are there grants for solar in Kenya? Yes, via KOSAP and DFIs for qualifying projects.

How has the Finance Bill 2025 affected solar? Potential cost increases due to VAT changes, but exemptions remain for now.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.