In the heart of Addis Ababa, Ethiopia, the 2nd Africa Climate Summit (ACS2) kicked off on September 8, 2025, drawing over 45 heads of state, UN officials, and thousands of delegates to tackle one of the most pressing issues of our time: climate finance.

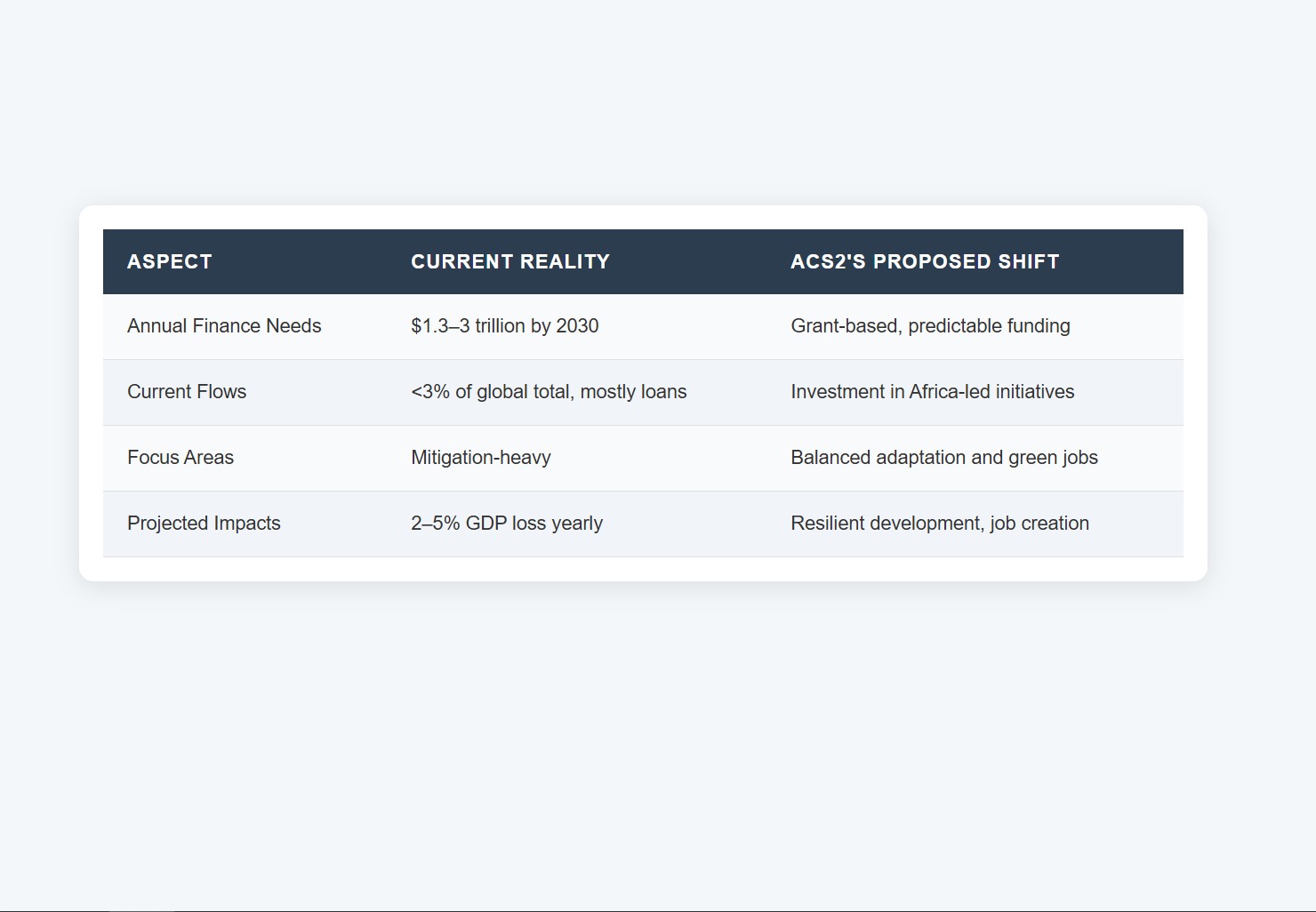

As the continent faces escalating climate impacts, costing 2–5% of GDP annually, ACS2 is positioning Africa not just as a victim of climate change but as a leader in global solutions.

With the theme “Accelerating Global Climate Solutions: Financing for Africa’s Resilient and Green Development”, this summit could fundamentally reform how the world funds climate action, shifting from inadequate aid to equitable, investment-driven models.

Africa’s Climate Finance Gap: The Urgent Case for Reform

Africa contributes less than 4% of global emissions yet bears the brunt of climate disasters, from droughts to floods.

The continent requires an estimated $3 trillion by 2030 to meet its climate adaptation and mitigation goals, but it currently receives under 3% of global climate finance. Much of this comes through high-interest loans that deepen debt burdens.

At ACS2, leaders like Ethiopian Prime Minister Abiy Ahmed stressed this injustice, announcing Ethiopia’s bid for the COP32 presidency while highlighting Africa’s renewable energy and critical minerals as opportunities for green-led growth.

Projections warn that without reform, climate costs could reach $440 billion this decade, pushing millions into poverty.

The summit amplifies calls for developed nations to finally deliver on the $100 billion annual climate finance pledge, while shifting emphasis from mitigation-heavy financing to adaptation that directly safeguards communities.

READ ALSO:

Kenya Set to Host First Kenyan-German E-Waste Innovation Summit

Key Proposals and Innovations on the ACS2 Table

Building on the 2023 Nairobi Declaration, delegates are advancing the Addis Ababa Declaration, a unified African position ahead of COP30 in Brazil. Central proposals include:

- Reforming global lenders like the IMF and World Bank to prioritise grant-based climate finance and debt relief.

- Tracking over 130 climate initiatives with measurable targets on adaptation, carbon credits, and monitoring pledges.

- Directing 10% of climate finance to green jobs and skills, with the potential to create 30 million roles by 2033.

Youth and civil society groups are demanding equitable access to the Green Climate Fund (GCF) and more support for nature-based solutions.

Organisations like Jacobs Ladder Africa are linking finance with workforce readiness in renewable energy and agriculture.

Meanwhile, side events are testing bold ideas, from carbon taxes to global tax reforms, aimed at funding just transitions.

Global Ripples and Challenges Ahead

If successful, ACS2 could reset global climate finance by positioning Africa as a solution provider rather than just a vulnerable region.

Its outcomes could strengthen Africa’s leverage at COP30, advancing a new collective quantified goal (NCQG) that goes beyond $100 billion and includes dedicated loss-and-damage funding.

This could inspire global mechanisms such as debt-for-climate swaps and concessional lending to vulnerable economies.

Yet, obstacles remain. Past summits have produced ambitious declarations without concrete results. Developed nations continue favouring loans over grants, and ensuring funds reach grassroots communities, especially women and youth, is a persistent challenge.

Balancing industrialisation with sustainability, particularly in resource extraction, will also test ACS2’s credibility.

Final Word

As ACS2 concludes on September 10, its true measure will lie in whether it can turn promises into progress. By linking finance to resilience, green jobs, and equity, Africa is not only demanding justice but also offering solutions that could reshape global climate action.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.