Proparco has invested in the Helios Climate Fund, a climate-focused private equity vehicle managed by Helios Investment Partners, as part of an expanded strategic partnership following Proparco’s USD 20 million commitment to Helios Sports & Entertainment Group in 2024.

This latest investment, announced in early February 2026, supports the fund’s second closing at approximately USD 250 million in total commitments.

The Helios Climate Fund unites prominent development finance institutions, including the European Investment Bank (EIB), FMO, British International Investment (BII), SIFEM, Swedfund, and BIO, with private investors such as InfraCo, Standard Bank, and the Emerging Markets Climate Action Fund (EMCAF).

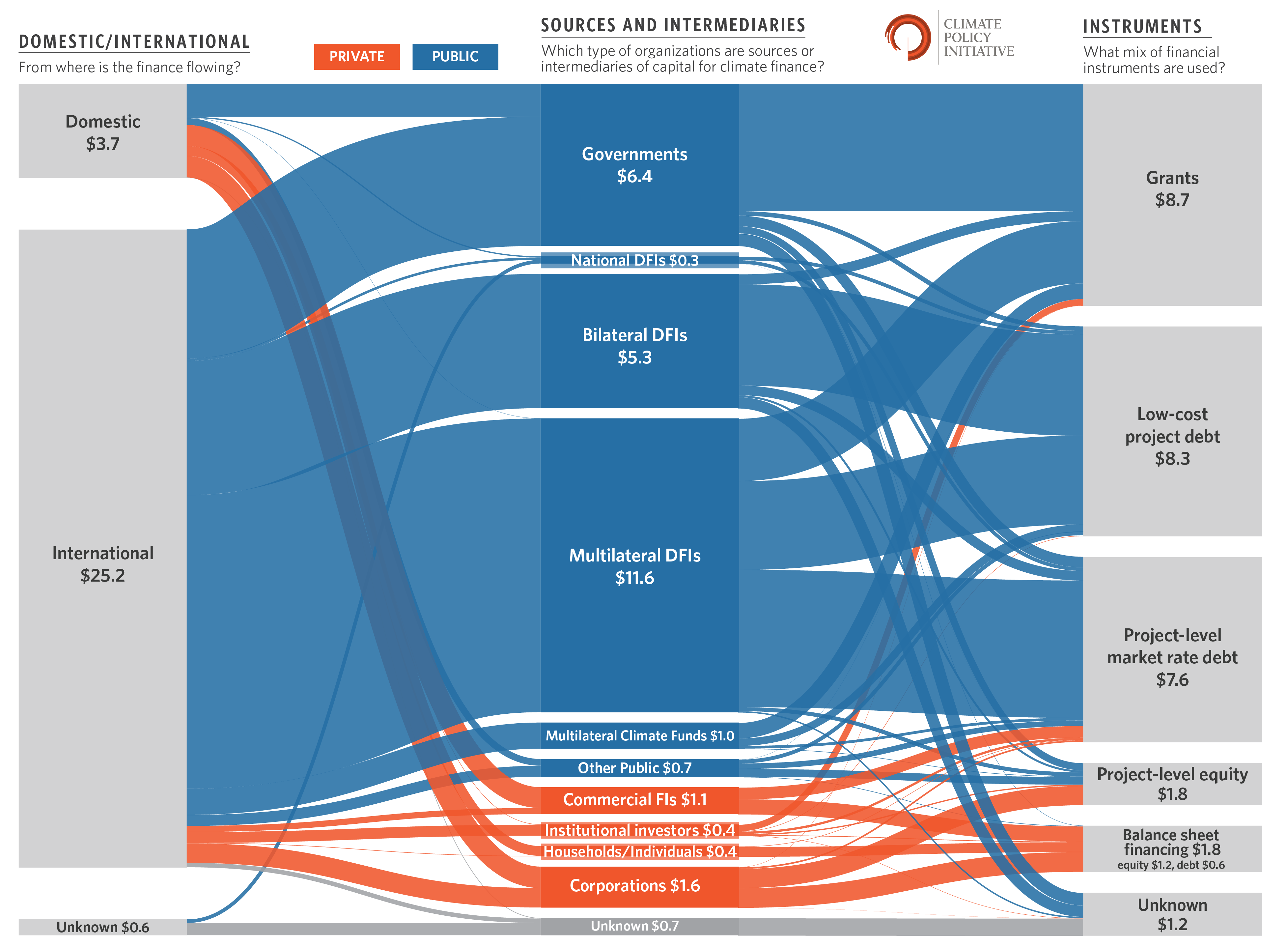

This blended finance structure combines concessional public capital with private investment to de-risk opportunities and mobilise larger-scale funding for climate solutions in Africa.

Fund Strategy and Investment Focus

The Helios Climate Fund targets significant minority or majority stakes, typically ranging from USD 20 million to USD 50 million, in companies that drive green growth and decarbonisation across roughly 15 sub-themes.

Priority sectors include affordable renewable energy, sustainable agriculture, green mobility, and other climate adaptation and mitigation solutions.

Approximately 40% of the fund’s disbursements are allocated to Africa, representing a higher regional concentration than many comparable blended finance vehicles.

This emphasis addresses the continent’s acute climate vulnerabilities and substantial opportunities for low-carbon transformation.

Helios Investment Partners brings a proven track record, having deployed more than USD 2.5 billion across 39 companies in 35 countries.

The firm has assembled a specialised team with deep sector knowledge to ensure rigorous due diligence and value creation in climate-related enterprises.

READ ALSO:

How Proparco Is Powering BasiGo’s Road to 1,000 Electric Buses

Role of Blended Finance in Scaling Impact

Blended finance plays a central role in this initiative by leveraging development finance institutions’ risk-tolerant capital to attract private investors.

Proparco’s participation lowers perceived barriers, enhances credibility, and enables the fund to pursue ambitious, high-impact projects that might otherwise remain underfunded.

Françoise Lombard, Chief Executive Officer of Proparco, stated: “The Helios Climate Fund seeks to mobilise private capital for Africa’s climate transition, where needs are immense and opportunities for transformation equally significant. By partnering with Helios Investment Partners, Proparco is backing an ambitious strategy that supports the scaling up of African companies while delivering measurable climate, economic, and social benefits.”

The partnership aligns with Proparco’s core priorities of environmental protection and resilient economic development. It contributes to multiple United Nations Sustainable Development Goals, notably SDG 13 (Climate Action), SDG 7 (Affordable and Clean Energy), SDG 8 (Decent Work and Economic Growth), and SDG 9 (Industry, Innovation, and Infrastructure).

Broader Implications for Africa’s Climate Finance Landscape

Africa faces disproportionate climate risks yet attracts only a fraction of global climate finance.

Blended structures like the Helios Climate Fund demonstrate renewed investor appetite for vehicles that bridge this gap, combining concessional support with private sector discipline to achieve scalable, measurable outcomes.

By focusing on market-leading businesses that address both mitigation and adaptation, the fund promotes sustainable growth, job creation, and resilience in key sectors.

This approach exemplifies how strategic partnerships can catalyse private capital mobilisation for Africa’s low-carbon transition.

Looking Ahead

Proparco’s investment in the Helios Climate Fund exemplifies the effective use of blended finance to scale climate solutions across Africa.

Through a collaborative structure that unites development institutions and private capital, the USD 250 million vehicle targets transformative investments in green sectors while delivering robust financial returns and measurable impact.

As of February 6, 2026, this commitment reinforces Proparco’s leadership in sustainable development finance and highlights growing momentum in Africa-focused climate investment.

For the most current details, consult official announcements from Proparco and Helios Investment Partners.

Overview

Helios Investment Partners is a London-based African private equity firm founded by Babatunde Soyoye and Tope Lawani, and while there isn’t a single public Helios Climate Fund CEO listed, the climate-focused investment strategy (Helios Climate) is co-led by partners such as Christopher North and Tavraj Banga under the Helios platform.

Helios raises and manages sequential funds, including Helios Fund IV and Helios Fund V, which invest across sectors in Africa, such as digital infrastructure, financial services, technology and climate-aligned businesses.

The firm itself is not a hedge fund but a private equity investor, and its Helios energy investments span renewable energy and clean infrastructure projects across Europe and beyond.

Proparco is a Paris-based development finance institution partly owned by the French Development Agency (AFD) and private shareholders, promoting sustainable private investment in emerging markets with equity, loans and advisory services; Proparco investments include backing funds such as the Helios Climate Fund to support low-carbon transitions in Africa.

Proparco company subsidiaries and initiatives include regional offices and technical assistance platforms like Digital Africa and the CREA Fund, which co-finance SMEs and creative industries with partners.

Proparco shareholders consist primarily of AFD with contributions from other public and private stakeholders, and the institution is led by CEO Françoise Lombard.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.